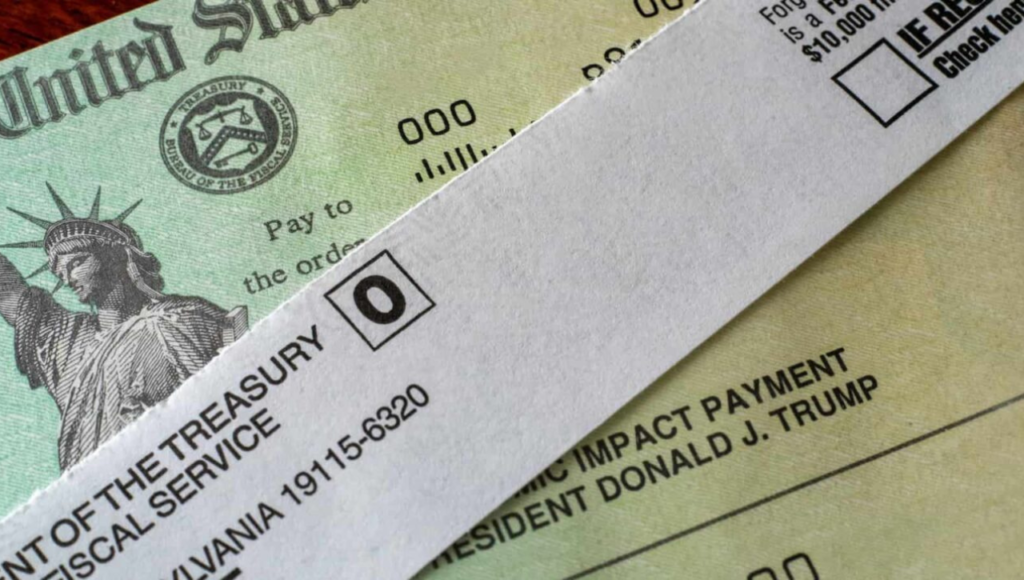

Time is running out for eligible Americans to claim their $1,400 stimulus check under the IRS Recovery Rebate Credit (RRC). The IRS has confirmed that more than one million taxpayers have yet to file their 2021 tax returns and could be entitled to a total of $1 billion in unclaimed refunds, with an average payout of $781. The final deadline to file and claim this stimulus check is April 15, 2025.

Why Is There a Stimulus Check in 2025?

This stimulus check is part of the third round of Economic Impact Payments distributed in 2021 under the American Rescue Plan. However, many individuals either didn’t receive the payment or didn’t claim it at the time. The IRS discovered this during a review of internal data and found a significant number of unfiled tax returns for 2021 — individuals who may still be eligible to receive the Recovery Rebate Credit.

Who Is Eligible for the $1400 Stimulus Check?

To be eligible for the payment:

- You must have a valid Social Security number.

- You must not be claimed as a dependent on someone else’s return.

- You must file your 2021 tax return before April 15, 2025.

- Your Adjusted Gross Income (AGI) must fall within the required thresholds:

| Filing Status | AGI Threshold (Full Payment) | Phase-out Ends |

|---|---|---|

| Single | Up to $75,000 | $80,000 |

| Married Filing Jointly | Up to $150,000 | $160,000 |

| Head of Household | Up to $112,500 | $120,000 |

Each eligible dependent also qualifies for a $1,400 payment, regardless of age.

How to File Your 2021 Return

If you haven’t filed your 2021 tax return yet, do so immediately. Here’s how:

- Create an IRS online account at irs.gov.

- Request missing forms from your employer or financial institution (like W-2, 1099, etc.).

- Request a tax transcript via mail or phone at 800-908-9946.

- Use a tax professional or IRS Free File if you’re unsure how to proceed.

Even if you’ve already filed your 2021 return but forgot to claim the RRC, the IRS may still process your refund automatically.

Tracking Your Stimulus Check Status

You can track your payment by logging into your IRS account and searching for:

- “Economic Impact Payment”

- “IRS TREAS 310” under your tax records.

You can also check your tax transcripts or call 800-919-9845 for further assistance.

Why Might Your Check Be Delayed?

Common reasons for delays include:

- Income exceeding the eligibility limits.

- Incorrect or outdated bank or contact information.

- Failure to file the 2021 return by the deadline.

- Returned payments due to change in address or closed bank accounts.

If you suspect your payment was delayed or misplaced, submit Form 3911 to the IRS to trace it.

Final Reminder

This is the last opportunity to claim your $1,400 stimulus check through the 2021 Recovery Rebate Credit. If you miss the April 15, 2025 deadline, the funds will be returned to the U.S. Treasury, and you forfeit your right to receive the payment.

FAQs

Q.What should I do if I missed claiming the Recovery Rebate Credit?

A: File or amend your 2021 tax return before April 15, 2025. If already filed, the IRS may automatically process your refund.

Q.What should I do if I missed claiming the Recovery Rebate Credit?

A.File or amend your 2021 tax return before April 15, 2025. If already filed, the IRS may automatically process your refund.

Q.How can I track my IRS $1400 stimulus deposit?

A: Log in to your IRS online account, check for entries like “IRS TREAS 310” or “Economic Impact Payment” under your tax records.

Q.Who is eligible for the $1400 stimulus check in 2025?

A: You must have a valid Social Security number, not be claimed as a dependent, and meet income limits based on your 2021 tax return.